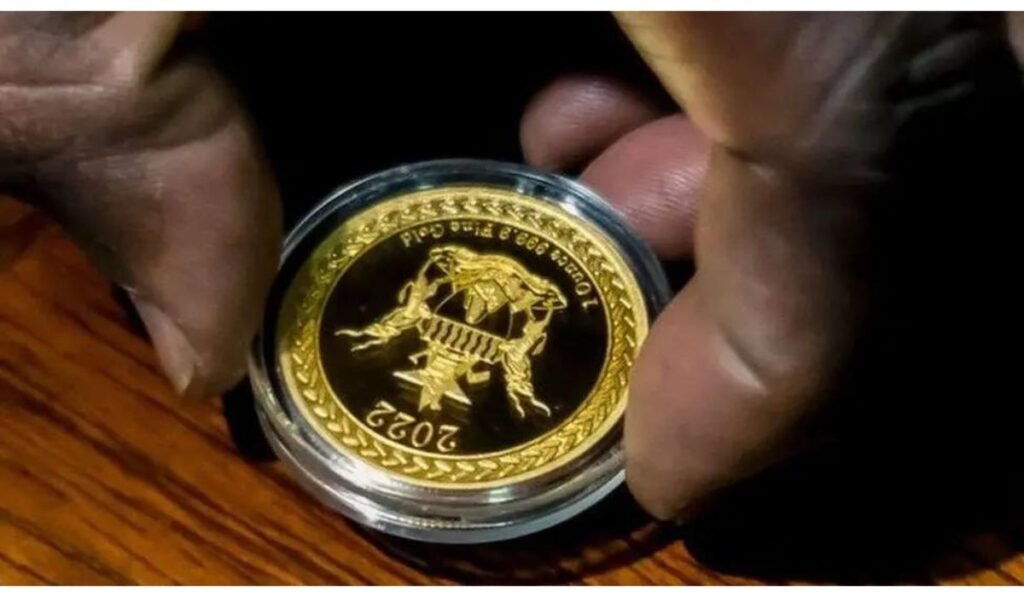

HARARE (Reuters) – Zimbabwe’s treasury said on Tuesday the newly introduced gold-backed currency is the official unit of exchange for transactions and that it would soon introduce regulations to ensure businesses stick to the official rate.

Although it has remained stable on the official market since its launch early April, the Zimbabwe Gold (ZiG) has been off to a nervy start on the parallel market, with traders charging a premium of 65% to the official rate to obtain dollars.

Some supermarkets charge a premium above the market rate, set at ZiG 13.6 per U.S. dollar. Informal traders reject the ZiG.

“To ensure orderly pricing, Government will soon be introducing the necessary regulations to ensure that no exchange rate other than the official rate will be used for the pricing of all goods and services,” Finance Minister Mthuli Ncube said in a statement.

Since its launch, the government has worked to sustain the ZiG, recently cracking down on illegal foreign currency traders.

Additionally, Zimbabwe must tackle logistical challenges, like establishing mechanisms for gold storage and distribution. Despite these hurdles, adopting a gold-backed currency represents a bold step towards economic revitalization and financial stability.

Looking ahead, Zimbabwe’s success with the gold-backed currency depends on several key factors. As Zimbabwe embraces this new economic chapter, adopting a gold-backed currency promises renewed prosperity.

read more

image source