NEW DELHI (Reuters) -Gautam Adani, founder of the Adani Group, addressed U.S. allegations on Saturday, denying involvement in a $265 million bribery scheme. He emphasized the conglomerate’s commitment to world-class regulatory standards. The Adani bribery indictment has created significant turmoil, shaking investor confidence and triggering political debates in India. #AdaniBriberyIndictment

This indictment marks the second major crisis for Adani in two years, shaking India and international markets alike. An Indian state is reconsidering a power deal with the group, while France’s TotalEnergies paused investments.

Political disputes over Adani have further disrupted India’s parliament, amplifying the controversy. The unfolding situation highlights the widespread impact of these allegations on both domestic and global platforms.

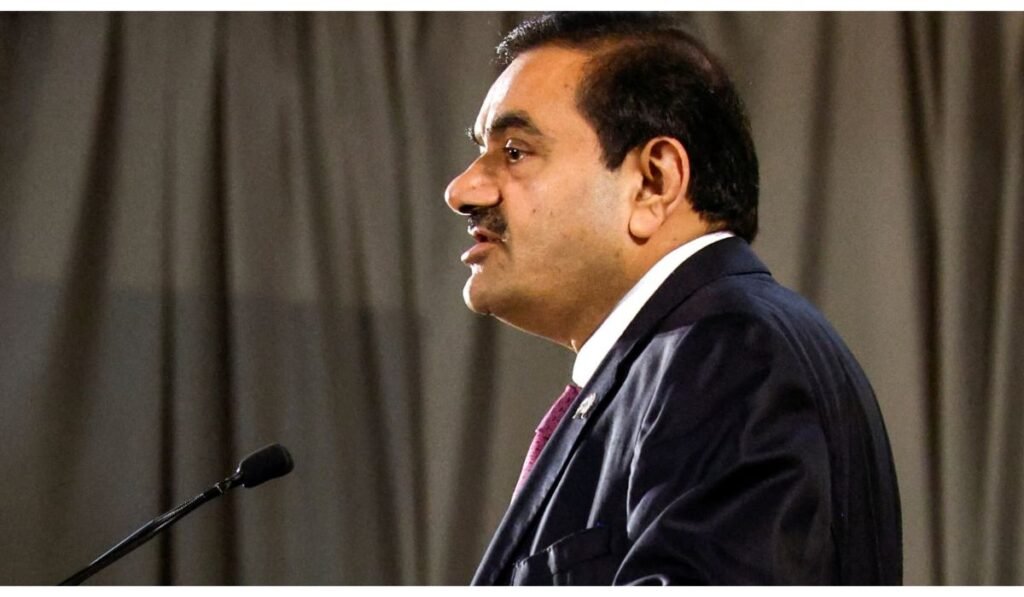

“Less than two weeks back, we faced a set of allegations from the U.S. about compliance practices at Adani Green Energy. This is not the first time we have faced such challenges,” Adani said in a speech at an awards ceremony.

U.S. authorities have alleged that Gautam Adani, his nephew Sagar Adani, and Adani Green’s managing director, Vneet S. Jaain, were involved in bribery. They are accused of paying bribes to secure Indian power supply contracts, raising serious concerns about the group’s operations.

The charges also claim that the trio misled U.S. investors during fundraising efforts, further escalating the controversy. These accusations have added pressure to the Adani Group’s reputation and global standing.

Adani Group has denied the allegations, describing them as “baseless” and vowing to seek “all possible legal recourse”.

“What I can tell you is that every attack makes us stronger and every obstacle becomes a stepping stone for a more resilient Adani Group,” Adani said in the northern Indian city of Jaipur.

“In today’s world, negativity spreads faster than facts, and as we work through the legal process, I want to re-confirm our absolute commitment to world class regulatory compliance,” he added, without giving further details.

Adani Group’s finance chief firmly dismissed the allegations on Friday, stating they lack merit. Meanwhile, the Indian government confirmed it had not received any official request from U.S. authorities regarding the case.

Earlier, Adani Group’s listed companies experienced a market value loss of up to $34 billion, highlighting the financial impact. However, the stocks have since regained momentum, supported by key partners and loyal investors who continue to back the conglomerate. #AdaniBriberyIndictment

Amid growing scrutiny, Adani Group’s finance chief strongly rejected the allegations, calling them baseless. Furthermore, the Indian government confirmed receiving no official communication from U.S. authorities. However, the Adani bribery indictment remains a contentious issue, with critics demanding transparency and accountability. Adani’s response marks a pivotal moment in navigating this challenging scenario.